FleetPartners launches innovative online vehicle leasing calculator

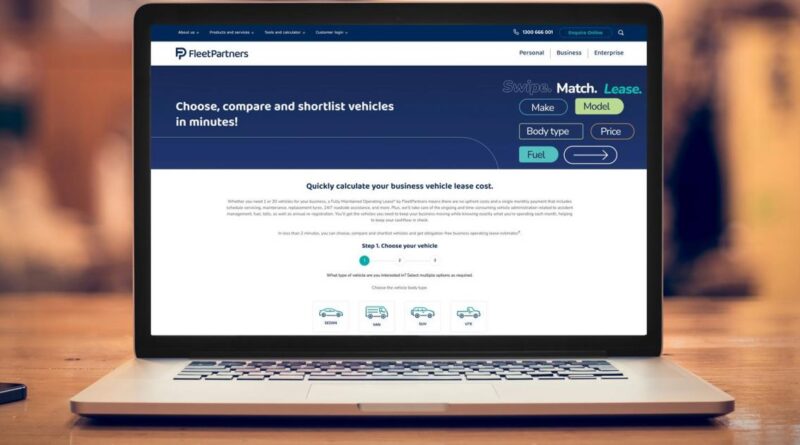

Business vehicle leasing specialist FleetPartners has launched a new online customer lease calculator and car chooser that’s designed to be a one-stop shop for fleet vehicle customers.

While existing calculators offered by finance and novated leasing companies can be limited to a purchase price, certain vehicle segment or popular models, the new FleetPartners online vehicle calculator allows users to browse and compare leasing costs for more than 1600 different new model variants.

Available to use now, the intuitive and seamless new technology helps customers search for vehicles that are suitable for their business, and shortlist and compare the monthly leasing payment for each of them.

Businesses can easily browse through models by searching for vehicles in broad segments like utes, vans and SUVs, or by refining their results to search for specific makes or fuel types.

The results can also be filtered for more specific features like body type, transmission, number of seats or within a weekly price range that suits your budget.

Customers can then request further information or create an online account and apply for low doc finance online with credit decisions typically within minutes, before FleetPartners helps source finalised quotes including any required accessories and available discounts, and then places an order with a dealer.

Hundreds of new car deals are available through CarExpert right now. Get the experts on your side and score a great deal. Browse now.

FleetPartners national sales manager Darren Smith said the company’s new vehicle lease calculator was just the latest step in the company’s support of its business customers and dealers through its omni channel technology solutions.

“The FleetPartners online calculator allows business customers to browse, shortlist and compare the estimated bundled operating lease cost of over 1600 new vehicles,” he said.

“Because the lease payment includes exclusive use of the vehicle for the life of the lease and most running costs like registration, servicing and replacement tyres, it’s now possible to digitally compare the potential total cost of ownership of a vehicle.

“Rather than just focussing on the RRP, a bundled lease helps compare the often forgotten running costs of a vehicle, like depreciation to its expected resale value, and how much to service and maintain the vehicle while using in your business.

“We know business owners are focussed on running their business and time poor, so providing a solution that allows them to research vehicles and pricing without even contacting a dealer, lender or fleet management company.

“After shortlisting the vehicles they are interested in, you can apply for a credit limit through a secure online portal. Automated credit limits of up to $150k are possible for applications with no financial statements needed, or if your business is larger you can request a manual credit review of up to $500k.

“We are excited to launch an online tool like this to support ABN holders with smaller fleets of typically two to 20 vehicles in their business.”

Offering leases on any new passenger and light commercial vehicle for up to 60 months or 200,000km, FleetPartners says its business lease program is more than just a finance solution that requires no capital outlay, no deposit, no balloon/residual payments and a full-service return and replace offering.

Scheduled services, stamp duty, statutory on-road costs, fuel management, replacement tyres, registration renewals and 24-hour roadside assistance are all bundled into one fixed monthly payment, reducing administration time and the total cost of ownership for customers.

FleetPartners also offers accident management services, toll/infringement management, a straight-through credit assessment platform, partner-enabled platform facilitating live vehicle lease quoting, secure finance application and credit assessment, automated approvals up to $150,000, as well as white-labelled and co-branded solutions for OEMs, dealerships and brokers.